Price decrease puts used Teslas in play for tax credit, report says

Image courtesy of Recurrent.

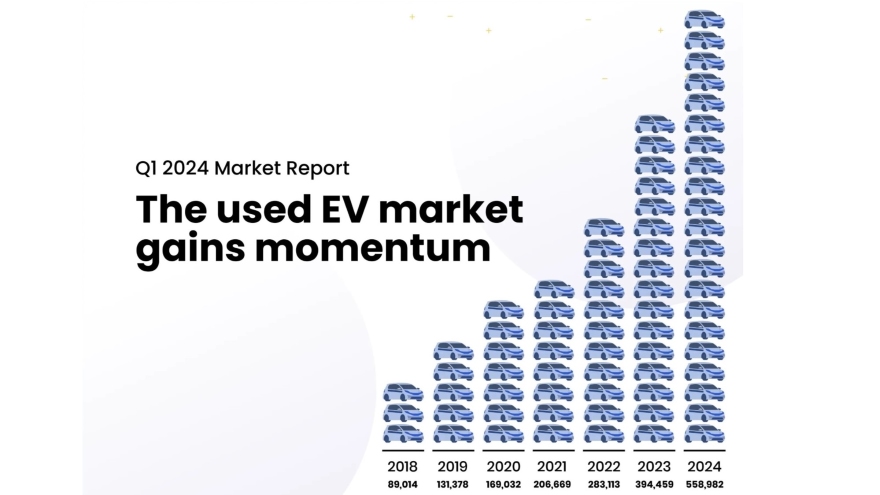

The used electric vehicle market is growing, and perhaps more important, used EV prices are coming down, according to research from EV data and analytics provider Recurrent.

The company’s Q1 Used EV Market Report found the average listing price of a 2017-2019 Tesla Model 3 has dropped below $30,000. That’s an important milestone because it puts them in play for the federal used EV tax credit of up to $4,000, since the actual purchase price is often less than the listing price.

The report noted the Model 3 offers significantly greater battery range than other EVs currently qualifying for the tax credit and said some 300,000 Models 3s were sold in the U.S. from 2017 to 2019.

As a result of the rise in longer-range models and EVs eligible for the tax rebate, Recurrent’s report forecast a sharp increase in used EV sales in 2024, predicting that by the end of the year a used EV will be sold every minute on average, with sales reaching 558,982 units.

That would be a jump of 42% over 2023 and up 97% from 2022.

“Our market indicators suggest that we are at the start of an inflection point for used electric cars in the U.S.,” Recurrent CEO Scott Case said in the report. “Shoppers no longer need to choose between range and affordability. A used EV shopper can drive home in a Tesla for less than $25,000.”

Another factor in that equation is the readiness of dealers to sell used EVs.

Beginning this year, dealerships must register with the Treasury Department to offer the $4,000 point-of-sale discounts on used EVs. But the Recurrent report found that while more than 7,000 dealerships have registered, just 7% of the 200 dealerships surveyed last month said they had taken steps to participate.

“As a used EV shopper, you definitely want to get this $4000 discount, but the rules aren’t straightforward,” Case said, adding shoppers need to know “which dealers, which vehicles and which buyers qualify.”

The full report is available here. Recurrent has also released a guide to the EV tax credits as well as a list of registered dealerships.

$16 million Series A funding round completed

In other news from the company, Recurrent announced it has completed its $16 million oversubscribed Series A funding round to scale out its used EV battery reports.

The funding round was led by ArcTern Ventures, with additional investment from Automotive Ventures, Goodyear Ventures, Wireframe Ventures, Pioneer Square Labs and others.

“Used EV value is unequivocally driven by a vehicle’s range and battery,” ArcTern Ventures partner Ian Pinnington said. “ArcTern conducted extensive primary research to develop the high conviction that Recurrent’s data-driven solution is not only the right approach, but is in a standalone market-leading position.

“As Recurrent continues to become a standard in the used EV ecosystem, we believe the company will inform all used EV transactions.”

View The Latest Edition

View The Latest Edition